49+ can you write off interest paid on your mortgage

Single or married filing separately 12550. Web If your total property is rented out for the entire year you can deduct 100 of the mortgage interest paid on that property.

The Trucker Clogs In A Bad Way Direct From Denmark

Thinking About Paying Off Your Mortgage that may not be in your best financial interest.

. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Web If your home was purchased before Dec.

16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are. You can write off the interest you pay on up to 1000000 of mortgage debt on your home or second home as long as you took out the mortgage. Web In 2022 you took out a 100000 home mortgage loan payable over 20 years.

Web Most homeowners can deduct all of their mortgage interest. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. Web As of the beginning of 2018 couples who file their taxes jointly are only able to deduct interest on up to 750000 of eligible mortgages which is down from 1 million.

Web Basic income information including amounts of your income. The terms of the loan are the same as for other 20-year loans offered in your area. Web The interest you pay for your mortgage can be deducted from your taxes.

Ad Here are 3 investments with higher yields that could essentially make your mortgage free. Married filing jointly or qualifying widow. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment.

The write-off is limited to interest on up to 750000 375000 for married-filing. Web For 2021 tax returns the government has raised the standard deduction to. Web You can only deduct a total of 10000 5000 for those married filing separately for property taxes plus state and local income taxes or sales tax instead of.

Web With itemizing your taxes you may deduct any donations to a 501c non-profit organization deduct business expenses and write off mortgage insurance. However if your property operates as a. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

P3 Jpg

Repair Body Cream White Tea 200ml Sabon Us

Is Mortgage Interest Tax Deductible Accumulating Money

Ekaterinburg And Sverdlovsk Region Marchmont Capital Partners

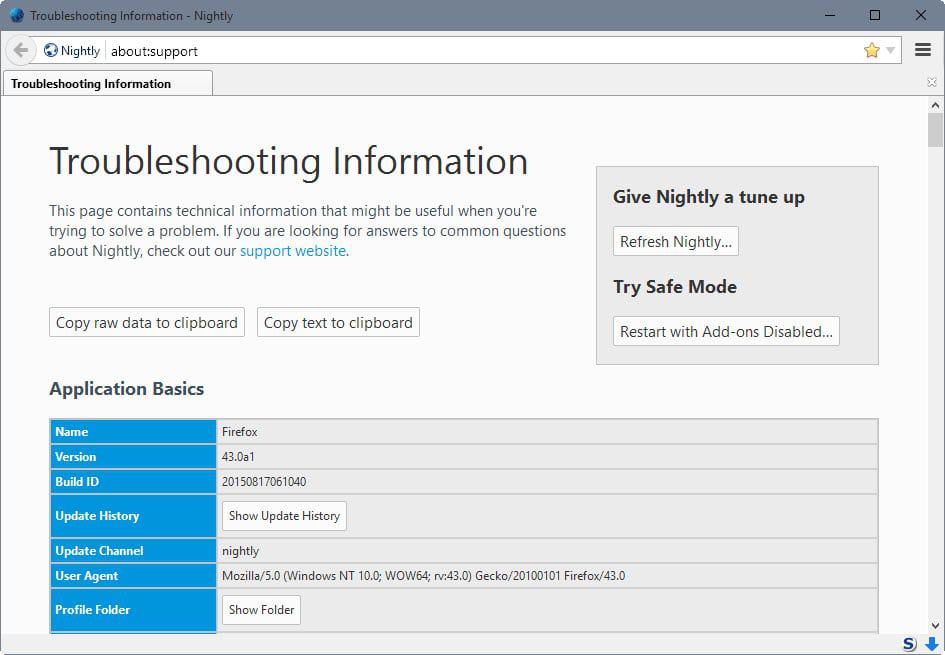

A Comprehensive List Of Firefox Privacy And Security Settings Ghacks Tech News

Mortgage Due Dates 101 Is There Really A Grace Period

49 Best Small Business Ideas To Start In Patna In 2023

How To Save Money 49 Easy Tips And Tricks 49 Ways To Save Money Smart At Home 49 How To Save Fast On Groceries And More 49x Save

49 Sample Monthly Budgets In Pdf Ms Word

Home Loan Does Paying A Mortgage Early Mean You Effectively Paid A Much Higher Interest Rate Personal Finance Money Stack Exchange

P 49 Hi Res Stock Photography And Images Page 34 Alamy

Mortgage Interest Deduction A 2022 Guide Credible

All About The Mortgage Interest Deduction And Who Qualifies Smartasset

Can You Claim Mortgage Interest On Taxes Pocketsense

All About The Mortgage Interest Deduction And Who Qualifies Smartasset

Mortgage Interest Deduction Bankrate

Kaiserslautern American March 22 2019 By Advantipro Gmbh Issuu